Features

Economy

Wage subsidy calculator helps employers navigate COVID-19 relief

By Talent Canada Staff

Parliament Hill in Ottawa. Photo: daoleduc/Getty Images

Parliament Hill in Ottawa. Photo: daoleduc/Getty Images The federal government has created on online calculator to help employers with the Canada Emergency Wage Subsidy (CEWS).

The CEWS is the 75 per cent wage subsidy available to employers that saw revenues decline by 15 per in March and 30 per cent for subsequent months. Full details on the program are available here. It provides a subsidy to a maximum of $847 per employee per week for up to 12 weeks, retroactive to March 15.

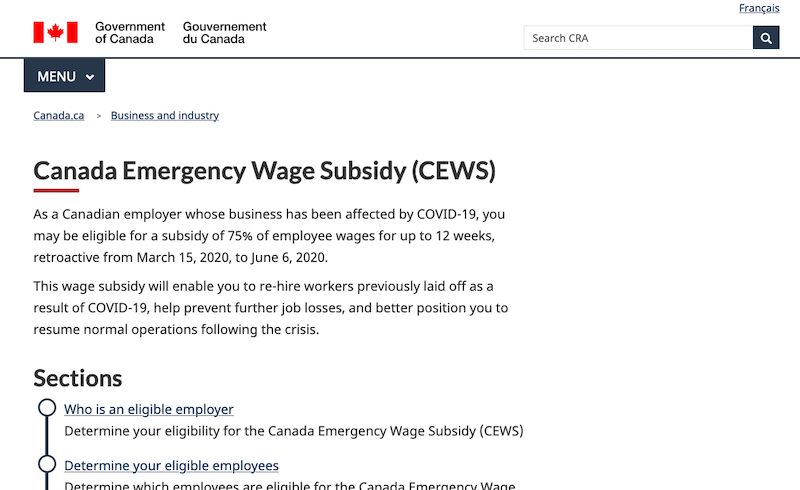

The CEWS calculator can be found on CRA’s Canada Emergency Wage Subsidy Web page. This web page incorporates feedback received during user testing with stakeholders, including the Canadian Federation of Independent Business and the Chartered Professional Accountants of Canada, the government said.

It includes detailed information and instructions about who can apply for the subsidy, how eligibility is assessed, and how the subsidy is calculated. The calculator also includes a printable statement feature that employers can use to view their claim at a glance and, as of April 27, enter required information into the CEWS application form quickly and easily.

A screenshot from the federal government’s new information page – featuring a calculator employers can use for the CEWS.

Dan Kelly, president of the Canadian Federation of Independent Business, said the CEWS will help many business owners retain staff during the pandemic.

“This will remove the stress of losing a job for workers and allow employers to bring their teams back together quickly as soon as the emergency phase is over,” said Kelly. “CFIB appreciates the work of the Canada Revenue Agency in operationalizing this key benefit. We were pleased to provide feedback to the CRA on its calculator designed to make it easier for firms to access the wage subsidy.”

“By providing employers with additional details about their subsidy claim, the CEWS calculator can equip employers with important information they can use now to make more informed decisions about retaining and re-hiring workers,” the government said in a press release. “A series of information sessions will be held in the coming days to provide a forum for eligible employers.

The CRA also encourages employers to sign up for My Business Account or Represent a Client, as employers will be able to apply through these portals. The CRA will open the application process on April 27, 2020. CEWS claims will be subject to verification by the CRA, therefore the CRA will begin to release funds for approved applications on May 5.

Quick facts

- The Canada Emergency Wage Subsidy is one of the measures the Government of Canada announced as part of their economic response to support Canadians through the COVID-19 pandemic.

- In addition, employer-paid contributions to Employment Insurance (EI), the Québec Parental Insurance Plan (QPIP), the Canada Pension Plan (CPP) and the Québec Pension Plan (QPP) will be refunded when paid in respect of employees that are on leave with pay.

Print this page