Features

Gig Economy

More than 870,000 Canadians work in gig economy: Statistics Canada

March 20, 2024

By

Talent Canada

The Uber sign on its engineering hub building in Toronto. Photo: JHVE/Adobe Stock

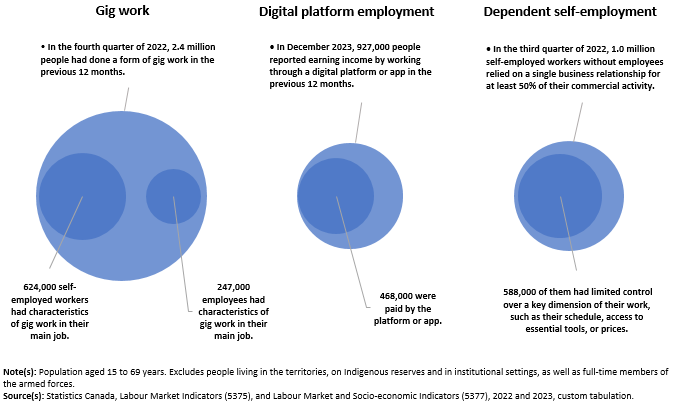

The Uber sign on its engineering hub building in Toronto. Photo: JHVE/Adobe Stock More than 870,000 Canadians did gig economy work in their main job in the fourth quarter of 2022, according to new data from Statistics Canada.

It found that an average of 624,000 self-employed Canadians, age 15 to 69, had a main job with the characteristics of gig work.

These characteristics include a lack of employees, business partners or a physical building or premises dedicated to their self-employment activity. Beyond that, these gig workers generally fell into two categories:

- those who worked very short hours or operated their business intermittently (91,000 workers); and

- those who usually dedicated more time to their business but did not have a stable client base (449,000 workers).

In addition, 84,000 self-employed workers had characteristics of both groups.

In addition to self-employed gig workers, 247,000 Canadians who were paid employees in their main job had employment characteristics that were consistent with the definition of gig work in the fourth quarter of 2022.

What is ‘gig’ work?

According to the definition found in the United Nations Economic Commission for Europe’s Handbook on Forms of Employment, gig work is a form of employment characterized by short-term jobs or tasks which does not guarantee steady work and where the worker must take specific actions to stay employed.

As gig work consists of short-term tasks or paid activities, it can also be done sporadically and does not always represent a main job or business. In October, November and December 2022, an additional 1.5 million people in Canada on average reported having done freelancing, paid gigs or short-term jobs or tasks at some point during the previous 12 months.

App-based platforms

Workers are increasingly using a range of online tools, platforms and apps, Statistics Canada said. These apps and platforms range from videoconferencing software to social media and have transformed the way many Canadians work or operate their business.

As part of this broad trend towards digitalization, a specific type of digital platform has emerged that creates economic value by coordinating or mediating the exchange of labour between individual workers and clients or buyers. Uber is a prime example of this, as it connects people looking for a ride with a taxi-type service. So is Skip the Dishes, which connects people with restaurants and delivery drivers, as well as AirBnb which pairs people seeking accommodation with property owners.

These platforms consist of an online marketplace or system that can connect workers directly with clients and often include coordination functions, such as algorithms to match workers and clients, a user rating system or tools to process payments. In recent years, digital platforms have become common in areas such as food delivery and personal transport.

According to Statistics Canada, 468,000 people age 15 to 69 (or 1.7 per cent of people in that age group) indicated they had worked through a digital platform or app to earn income in the previous 12 months and were paid by the platform for their work.

Among them, 368,000 indicated that they had provided a service and 103,000 reported that they had sold goods or leased accommodation. For 79,000 people (0.4% of the employed population), working through such digital platforms or apps was their main job or business during the December 2023 Labour Force Survey reference week.

The broadest definition of digital platform employment includes platforms that pay workers directly, those that exercise another form of control, and those that simply connect workers with clients and let them arrange the payment by themselves. Based on this definition, 927,000 people (3.3% of the population aged 15 to 69 years) reported that they had engaged in digital platform employment in the 12 months preceding December 2023.

Independent contractors, not employees

Self-employed gig workers and workers who work through digital platforms sometimes lack access to the full benefits associated with being self-employed, such as the freedom to hire paid help, choose their work hours or set their own prices.

At the same time, as self-employed gig workers and workers who work through digital platforms are paid as independent contractors, they do not have access to the same benefits as employees, such as protection under employment standards legislation.

When a self-employed worker depends on another business or person for a large part of their commercial activity, and when that second business or person controls key aspects of the work, a self-employed worker may be in a situation of dependent self-employment. Not all digital platform workers are in dependent self-employment, and other business relationships can lead to these circumstances, such as self-employed workers who work for a single client.

In June, July and August 2022, an average of 1.0 million self-employed workers without employees aged 15 to 69 years were dependent on a single business relationship for at least 50% of their commercial activity. Among them, 427,000 relied on a single main client and 235,000 relied on another company or person subcontracting tasks, projects or clients.

Of these 1.0 million workers, 588,000 were in a situation where the other party exercised a large extent of control over a key dimension of their work, such as their schedule, the organization of their work or the supply of essential tools or materials.

Print this page